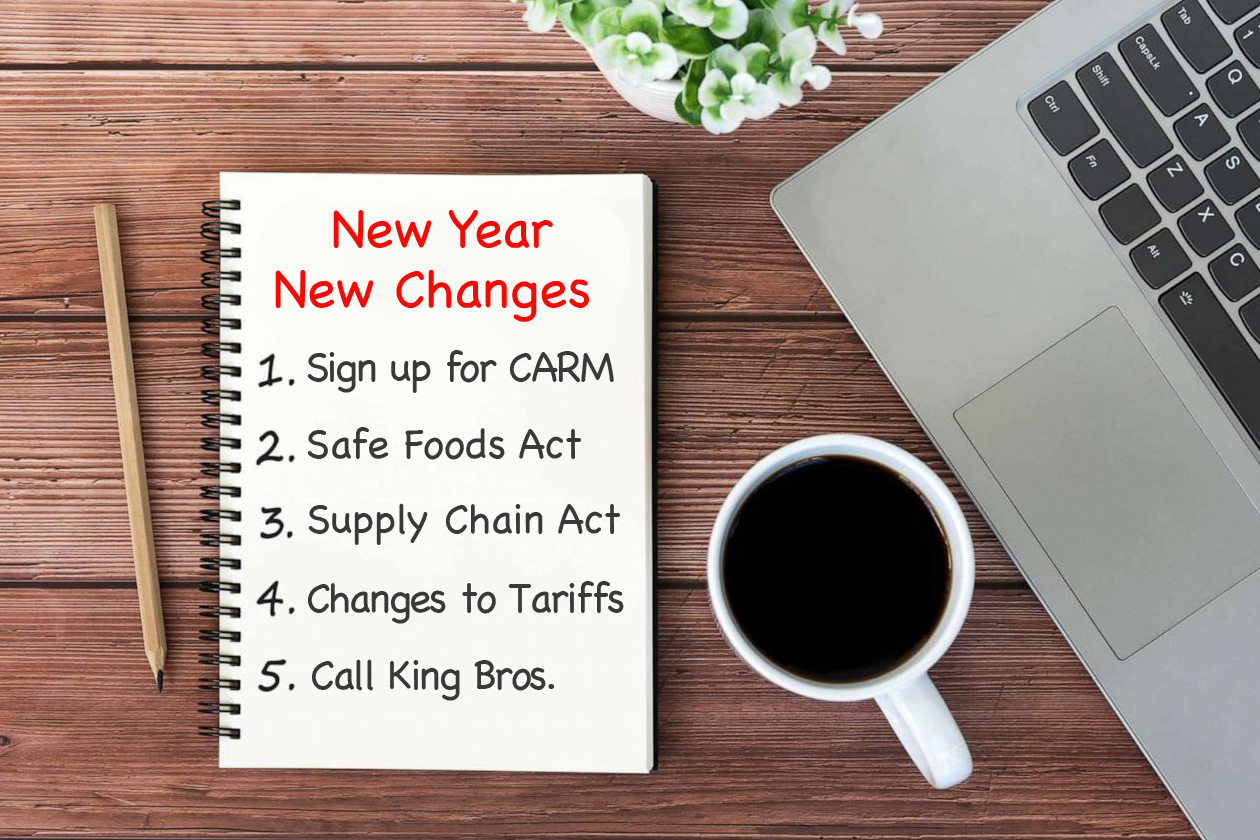

New Year, New Changes.A New Year often brings new changes, and the import environment is not immune from this process.

By now, most importers are at least aware of the impending changes associated with CARM, even if they have not yet established an account in the Customs Client Portal and delegated authority to their broker.

CARM represents the single most significant change to the import process in Canada in decades, but that doesn’t mean there are not other changes to note.

—

In January of 2019, the Safe Foods for Canadians Regulations came into force to better protect food safety, and to govern the import, export, and inter-provincial trade of food for human consumption.

A requirement for a Safe Foods for Canadians Licence was introduced at that time which applied to certain foods. The licence requirement has since expanded to cover a more extensive array of manufactured foods, and effective February 12th 2024, the importer’s licence number will be required to be declared electronically at the time of import rather than simply being held by the importer.

It will be incumbent upon importers and brokers to know precisely the foodstuffs being declared, using the correct HS and OGD extensions, or risk having entries rejected.

—

January 1st 2024 saw the implementation of the Supply Chains Act, whose goal is to eliminate goods produced from forced labour within the Canadian supply chain.

Medium and large business enterprises are now obligated to file an annual report with the Minister of Public Safety by May 31st of each year detailing the steps taken by the company to prevent and reduce the risk that forced or child labour exists within their supply chains.

Businesses affected are those with assets in excess of $20M, revenue in excess of $40M, or with an employee base of over 250 who produce, sell, or distribute goods in Canada.

The first report is due on May 31st of this year.

—

In addition to the above, annual changes to certain tariff classifications, duty rates, and trade agreements are also standard, so it is important for importers, when in doubt, to consult with their brokers to ensure that declarations are correct and that compliance with various governmental departments is being met.

—

Change is a fact of life and a fact of business, but King Bros. Limited remains committed to supporting our clients through all facets of change.

Please connect with one of our friendly customs brokers, and we will be happy to help.

A New Year often brings new changes, and the import environment is not immune from this process.

By now, most importers are at least aware of the impending changes associated with CARM, even if they have not yet established an account in the Customs Client Portal and delegated authority to their broker.

CARM represents the single most significant change to the import process in Canada in decades, but that doesn’t mean there are not other changes to note.

—

In January of 2019, the Safe Foods for Canadians Regulations came into force to better protect food safety, and to govern the import, export, and inter-provincial trade of food for human consumption.

A requirement for a Safe Foods for Canadians Licence was introduced at that time which applied to certain foods. The licence requirement has since expanded to cover a more extensive array of manufactured foods, and effective February 12th 2024, the importer’s licence number will be required to be declared electronically at the time of import rather than simply being held by the importer.

It will be incumbent upon importers and brokers to know precisely the foodstuffs being declared, using the correct HS and OGD extensions, or risk having entries rejected.

—

January 1st 2024 saw the implementation of the Supply Chains Act, whose goal is to eliminate goods produced from forced labour within the Canadian supply chain.

Medium and large business enterprises are now obligated to file an annual report with the Minister of Public Safety by May 31st of each year detailing the steps taken by the company to prevent and reduce the risk that forced or child labour exists within their supply chains.

Businesses affected are those with assets in excess of $20M, revenue in excess of $40M, or with an employee base of over 250 who produce, sell, or distribute goods in Canada.

The first report is due on May 31st of this year.

—

In addition to the above, annual changes to certain tariff classifications, duty rates, and trade agreements are also standard, so it is important for importers, when in doubt, to consult with their brokers to ensure that declarations are correct and that compliance with various governmental departments is being met.

—

Change is a fact of life and a fact of business, but King Bros. Limited remains committed to supporting our clients through all facets of change.

Please connect with one of our friendly customs brokers, and we will be happy to help.