Just what is an HS Code?The Harmonized Tariff Schedule (HTS) is an international classification system by which any physical product can be assigned an identification number. The purpose of the HTS is to standardize the classification of goods across national boundaries, and the system has been adopted by almost every country in the world.

There are a variety of reasons why you may need to know the HS code for a product that you are importing or exporting. HS Codes are often required to be listed on certificates of origin, for example. The HS number of a product determines the amount of duty to be paid, so it’s important to use the correct classification.

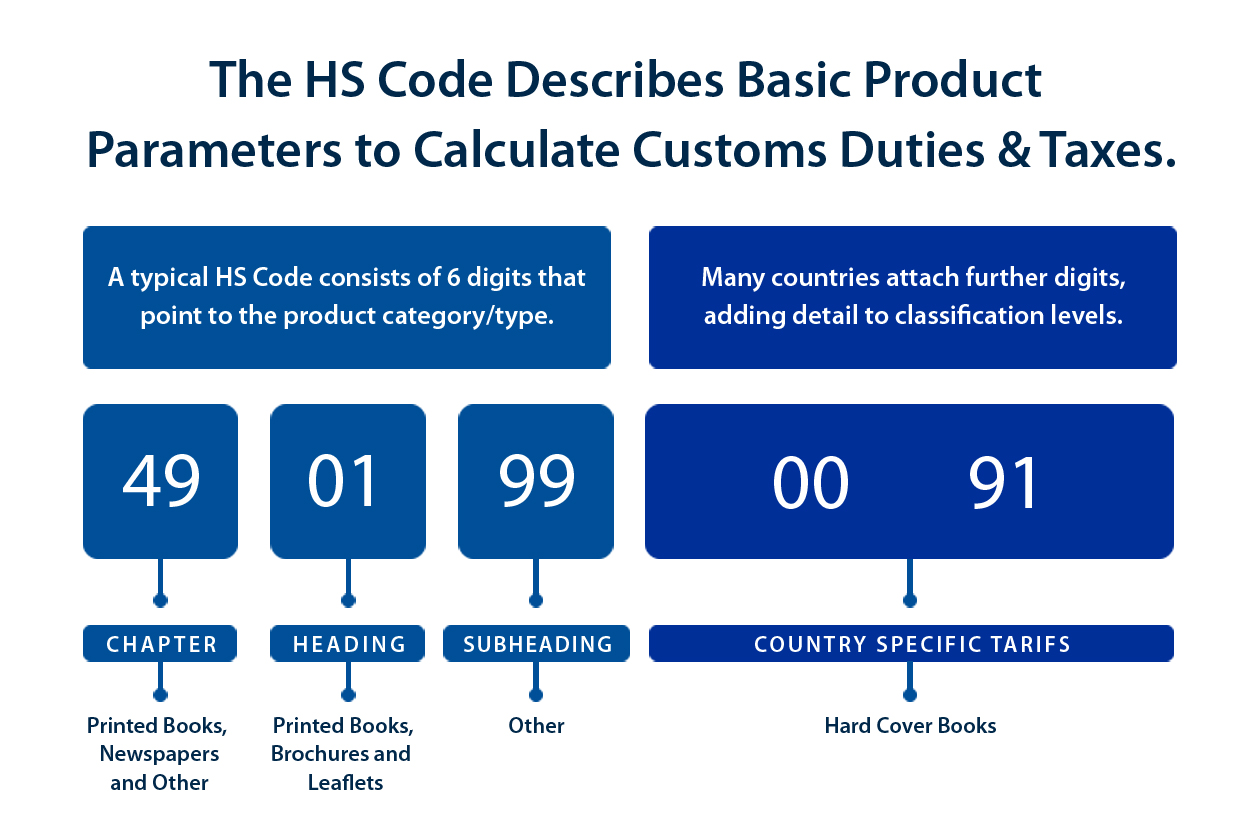

The international Harmonized System assigns every item a six-digit number and countries can choose to add additional numerical suffixes to the end, as illustrated above. Canada and the USA both add four-digit suffixes, so Canadian and American HS codes are ten digits long. In the USA, the first six digits are called the Schedule B number.

The international standard HS tariff is administered by the World Customs Federation and updated every five years. However, countries may update their own suffixes more frequently than that. The Canadian Customs Tariff, for example, is updated every few months. The full Canada HS Tariff is available online here.

Canadian HS codes have ten digits: the first two digits signify the chapter of the HS tariff that the product falls into; the next two digits are the heading within that chapter; the next two digits are the subheading; then there are two sets of two-digit tariff items that are unique to Canada. There are 99 chapters in the HS tariff, going from least processed items to most processed. For example, live animals are in chapter one, raw vegetables are in chapter seven, plastics in chapter 39, iron in chapter 73, and computers in chapter 84.

As an example, let’s look up the HS code for a book. Let’s say I’m importing a hardcover copy of the new hit bestselling book I Know This is Annoying But I Promise It’s Important: Memoirs of a Customs Broker.

Looking at the list of chapters in the current Canada HS tariff for December 2022, I see that chapter 49 is called “Printed books, newspapers, pictures and other products of the printing industry; manuscripts, typescripts and plans.” So my book is probably going to be classified in chapter 49.

When I open chapter 49, heading 49.01 is for “Printed books, brochures, leaflets and similar printed matter, whether or not in single sheets.” It sounds like my book will be classified in 49.01.

The first subheading is 4901.10.00.00: “In single sheets, whether or not folded.” My book is bound, so it doesn’t fit under that subheading and we have to keep looking.

The next subheading is 4901.91.00.00: “Dictionaries, encyclopedias and serial instalments thereof.” My book is a memoir, so we keep going.

The last subheading under 49.01 is 4901.99.00: “Other.” Since my book should be in 49.01 and there are no other subheadings, it must go under 4901.99.00.

We still need the last two digits of the HS code, and subheading 4901.99.00 contains 11 tariff items for specific types of books: item 22 for post-secondary textbooks, item 40 for liturgical books, item 70 for newspapers and journals, and so on.

Finally, item 91 is “Hard Cover Books,” so 91 will be the last two digits of the classification number. The full Canadian classification number for my book is 4901.99.00.91.

If you’ve ever been irritated by your customs broker asking for extra details about your products (“Is the fabric knitted or woven?” “Do the shoes have leather or rubber soles?” “Hardcover or paperback?”), this process is the reason they’re asking: they are classifying the item in the HS tariff, and they need specific information to find the right classification.

Canada Post has an online HS Code search tool for six-digit HS codes, and for goods going into the USA, the US Census Bureau offers an online Schedule B Search Engine. However, these tools can be imprecise. Classification of goods in the HS tariff is notoriously complex, and depends on an accurate interpretation of the HS tariff, the explanatory notes, and the General Interpretive Rules. There are six international General Interpretive Rules plus three additional Canadian General Interpretive Rules, available online here. Each chapter in the tariff also has additional notes at the beginning that govern the classification of goods in that chapter specifically.

Using the wrong HS code can cause problems. A certificate of origin which is filled out with the wrong HS code might not be accepted by customs, costing you additional customs duties. In extreme cases, misclassification of goods can result in penalties from CBSA.

If you need to know the HS code of your products, your best bet is always to ask your customs broker. A good broker will be very familiar with their country’s HS tariff and know how to correctly classify goods. While the ultimate responsibility for providing accurate information to customs rests with the importer, part of the service offered by your broker should be to ensure that your goods are classified under the correct HS code.

If you have any questions about HS classifications or brokerage services, get in touch!

By Robin Smith, M.A., CCS

– Robin is a trade industry professional based in Victoria, BC.

The Harmonized Tariff Schedule (HTS) is an international classification system by which any physical product can be assigned an identification number. The purpose of the HTS is to standardize the classification of goods across national boundaries, and the system has been adopted by almost every country in the world.

There are a variety of reasons why you may need to know the HS code for a product that you are importing or exporting. HS Codes are often required to be listed on certificates of origin, for example. The HS number of a product determines the amount of duty to be paid, so it’s important to use the correct classification.

The international Harmonized System assigns every item a six-digit number and countries can choose to add additional numerical suffixes to the end, as illustrated above. Canada and the USA both add four-digit suffixes, so Canadian and American HS codes are ten digits long. In the USA, the first six digits are called the Schedule B number.

The international standard HS tariff is administered by the World Customs Federation and updated every five years. However, countries may update their own suffixes more frequently than that. The Canadian Customs Tariff, for example, is updated every few months. The full Canada HS Tariff is available online here.

Canadian HS codes have ten digits: the first two digits signify the chapter of the HS tariff that the product falls into; the next two digits are the heading within that chapter; the next two digits are the subheading; then there are two sets of two-digit tariff items that are unique to Canada. There are 99 chapters in the HS tariff, going from least processed items to most processed. For example, live animals are in chapter one, raw vegetables are in chapter seven, plastics in chapter 39, iron in chapter 73, and computers in chapter 84.

As an example, let’s look up the HS code for a book. Let’s say I’m importing a hardcover copy of the new hit bestselling book I Know This is Annoying But I Promise It’s Important: Memoirs of a Customs Broker.

Looking at the list of chapters in the current Canada HS tariff for December 2022, I see that chapter 49 is called “Printed books, newspapers, pictures and other products of the printing industry; manuscripts, typescripts and plans.” So my book is probably going to be classified in chapter 49.

When I open chapter 49, heading 49.01 is for “Printed books, brochures, leaflets and similar printed matter, whether or not in single sheets.” It sounds like my book will be classified in 49.01.

The first subheading is 4901.10.00.00: “In single sheets, whether or not folded.” My book is bound, so it doesn’t fit under that subheading and we have to keep looking.

The next subheading is 4901.91.00.00: “Dictionaries, encyclopedias and serial instalments thereof.” My book is a memoir, so we keep going.

The last subheading under 49.01 is 4901.99.00: “Other.” Since my book should be in 49.01 and there are no other subheadings, it must go under 4901.99.00.

We still need the last two digits of the HS code, and subheading 4901.99.00 contains 11 tariff items for specific types of books: item 22 for post-secondary textbooks, item 40 for liturgical books, item 70 for newspapers and journals, and so on.

Finally, item 91 is “Hard Cover Books,” so 91 will be the last two digits of the classification number. The full Canadian classification number for my book is 4901.99.00.91.

If you’ve ever been irritated by your customs broker asking for extra details about your products (“Is the fabric knitted or woven?” “Do the shoes have leather or rubber soles?” “Hardcover or paperback?”), this process is the reason they’re asking: they are classifying the item in the HS tariff, and they need specific information to find the right classification.

Canada Post has an online HS Code search tool for six-digit HS codes, and for goods going into the USA, the US Census Bureau offers an online Schedule B Search Engine. However, these tools can be imprecise. Classification of goods in the HS tariff is notoriously complex, and depends on an accurate interpretation of the HS tariff, the explanatory notes, and the General Interpretive Rules. There are six international General Interpretive Rules plus three additional Canadian General Interpretive Rules, available online here. Each chapter in the tariff also has additional notes at the beginning that govern the classification of goods in that chapter specifically.

Using the wrong HS code can cause problems. A certificate of origin which is filled out with the wrong HS code might not be accepted by customs, costing you additional customs duties. In extreme cases, misclassification of goods can result in penalties from CBSA.

If you need to know the HS code of your products, your best bet is always to ask your customs broker. A good broker will be very familiar with their country’s HS tariff and know how to correctly classify goods. While the ultimate responsibility for providing accurate information to customs rests with the importer, part of the service offered by your broker should be to ensure that your goods are classified under the correct HS code.

If you have any questions about HS classifications or brokerage services, get in touch!

By Robin Smith, M.A., CCS

– Robin is a trade industry professional based in Victoria, BC.